Attorney General James Sues Company Behind Zelle for Enabling Widespread Fraud

NEW YORK – New York Attorney General Letitia James sued Early Warning Services, LLC (EWS), a company owned and controlled by a group of the largest banks in the United States that was tasked with developing and operating the electronic payment platform Zelle, for failing to protect its users from massive amounts of fraud. An investigation by the Office of the Attorney General (OAG) revealed that EWS designed Zelle without critical safety features, allowing scammers to easily target users and steal over $1 billion between 2017 and 2023. EWS knew from the beginning that key features of the Zelle network made it uniquely susceptible to fraud, and yet it failed to adopt basic safeguards to address these glaring flaws or enforce any meaningful anti-fraud rules on its partner banks. Attorney General James filed this lawsuit after the Consumer Financial Protection Bureau (CFPB) abandoned a similar lawsuit, filed in December 2024, following the change in the federal administration. With this lawsuit, Attorney General James is seeking restitution and damages for affected New Yorkers, as well as a court order mandating Zelle maintain anti-fraud measures necessary to protect its users.

“No one should be left to fend for themselves after falling victim to a scam,” said Attorney General James. “I look forward to getting justice for the New Yorkers who suffered because of Zelle’s security failures.”

EWS is a financial technology company owned and controlled by a group of the country’s largest banks, including JPMorgan Chase, Bank of America, Capital One, and Wells Fargo. Those banks tasked EWS with hastily launching an electronic payment platform to compete with payment apps like Venmo, PayPal, and CashApp, which were not controlled by banks. In their rush to launch, EWS prioritized attracting new users through a simple registration process and quick transfers that left consumers vulnerable to scammers.

Zelle’s advertisements misleadingly promised safe and secure money transfers. In reality, the banks backing it objected to basic anti-fraud safeguards.

Beginning in 2017, the year Zelle launched, anyone with a U.S. bank account could enroll in Zelle and send or receive near-instant money transfers through linked email addresses or U.S.-based mobile phone numbers. Scammers could sign up through a quick registration process that lacked important verification steps, allowing them to utilize misleading email addresses such as those associated with trusted businesses or government entities. Zelle’s emphasis on immediate and irreversible transfers means that by the time consumers realize they have been targeted by fraudsters, their money is often already gone.

As a result, Zelle quickly became a hub for fraudulent activity. The most common scams involved fraudsters gaining access to users’ accounts and making unauthorized transfers, and scammers convincing users to send funds under false pretenses, for example by offering non-existent goods or services or by impersonating a trusted institution like a bank or government office.

In one example of a common scam using Zelle, a New York user received a call from an individual impersonating a Con Edison employee advising that the consumer was delinquent on his energy bills and that his “electricity was going to be shut off that day” unless he paid Con Edison via Zelle. The fraudster identified “Coned Billing” as the name associated with the account. The consumer transferred $1,476.89 to a Zelle account named “Coned Billing,” but after realizing the call was a scam, was told by their bank, JPMorgan Chase, that the bank “can’t get [him] that money back.”

The OAG’s investigation revealed that EWS and its partner banks knew for years that fraud was spreading on Zelle and failed to take meaningful action to stop it. When participating banks received complaints from Zelle users about fraud, EWS allowed banks to report that fraud to EWS long after it occurred, which enabled bad actors to scam additional consumers. In fact, when Zelle launched, EWS did not require participating banks to report scams like the “Coned Billing” scheme in which fraudsters convinced users to send funds under false pretenses. Even when EWS did receive reports of fraud, it failed to promptly remove the fraudsters from the Zelle network or require banks to reimburse consumers for certain scams. EWS developed basic safeguards to address these issues as early as 2019, but failed to adopt them. EWS failed to meaningfully enforce even the limited, inadequate anti-fraud rules that it did have in place against participating banks despite knowing of widespread violations of those rules.

EWS aggressively marketed Zelle to New Yorkers, promising safety and security. However, EWS’s failures enabled fraudsters to run rampant on the Zelle network, leading to millions of dollars in losses for New Yorkers.

Attorney General James alleges that EWS violated New York law by creating a payment platform highly susceptible to fraud and doing little to stop it for years while falsely marketing it as a safe and secure service. With this lawsuit, Attorney General James is seeking restitution and damages for all affected New Yorkers and court orders mandating EWS maintain necessary anti-fraud safeguards and take other steps to protect their customers from fraud.

In June, Attorney General James sued payday lending companies DailyPay and MoneyGram for exploiting workers with predatory loans. In May, Attorney General James sued Capital One for misleading its customers and cheating them out of millions of dollars of interest payments. In January 2024, Attorney General James sued Citibank for failing to protect its customers from fraud. In April 2022, Attorney General James led a multistate coalition of attorneys general in calling on the CEOs of JPMorgan Chase, Bank of America, U.S. Bank, and Wells Fargo to eliminate all overdraft fees on consumer bank accounts.

Attorney General James encourages all consumers who have lost money to scammers through Zelle to report their experiences to the OAG’s Consumer Frauds Bureau.

This matter is being handled by Assistant Attorneys General Chris Filburn and Christian Reigstad with the Consumer Frauds and Protection Bureau. The Consumer Frauds and Protection Bureau is led by Bureau Chief Jane M. Azia and Deputy Bureau Chief Laura J. Levine, and is a part of the Division of Economic Justice, which is overseen by Chief Deputy Attorney General Chris D’Angelo and First Deputy Attorney General Jennifer Levy. n

{Stefanik Calls For Gov. Kathy Hochul to Come Clean on Prison Strikes

Saratoga, N.Y., –House Republican Leadership Chairwoman Elise Stefanik released the following statement:

“Kathy Hochul has turned her back on law enforcement officers again and again, especially our hardworking correctional officers. In a scathing report that blasts [her] for putting the rights of violent inmates over law enforcement, the union representing Correction Officers stated they warned Kathy Hochul before their strike that prisons were a dangerous powder keg, a strike was imminent, and that lives of officers were at risk. Hochul took no action and instead chose to destroy the lives of correctional officers and their families.”

The New York State Correctional Officers & Police Benevolent Association (NYSCOBA) confirms this fact in their post-strike report:

At NYSCOPBA’s Executive Assembly held in Syracuse on February 5-6, a significant number of our members expressed their strong belief that the State had ignored our concerns and would continue doing so…the membership had made their frustrations known.

Shortly after, we showed a videotape of this meeting to a top public safety aide to Governor Hochul during a meeting at NYSCOPBA’s Albany headquarters. We took this unprecedented step because NYSCOPBA wanted the Governor’s office to see firsthand the high level of frustration among the membership. After watching the video, this aide stated that he was going to discuss it with the Governor and express to her that the NYSCOPBA membership needed to see tangible changes immediately.

Still, nothing happened…State’s leaders ignored our warnings that an unsanctioned strike was likely. Regrettably, as at every stage leading to February 17, 2025, State leaders chose to disregard the warnings and failed to address the crisis.

“Strikes commenced across the state, wreaking havoc in prisons. Hochul callously fired an estimated 2,000 Correction Officers throughout the three week strike she knew was going to happen. The lives of thousands of New York National Guard reservists were put at risk when Hochul forced them to guard inmates with no training. The State pegged staggering strike costs at $100 million per month. Prison strikes could have been avoided. Kathy Hochul ignored the warning signs out of incompetence or indifference to law enforcement. Kathy Hochul must immediately address NYSCOBA’s report: what did she know, when did she know it, and why did she refuse to act?” said Chairwoman Stefanik. n

{Nassau County Executive Bruce Blakeman Joins Sullivan Papain Law Firm To Mark Anniversary Of Tobacco Master Settlement Agreement

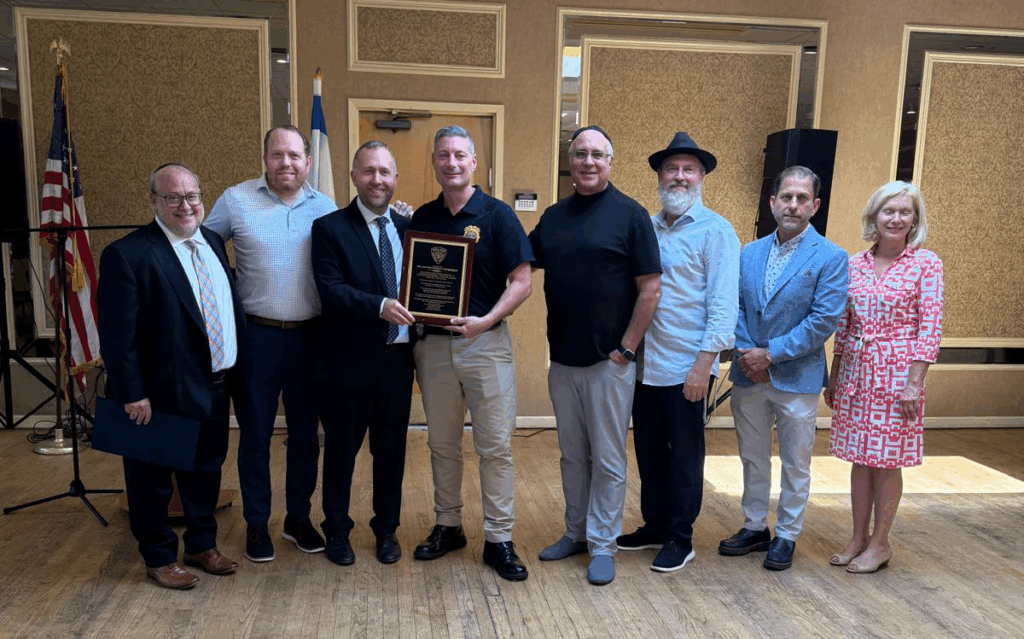

{IMG Nassau County Executive Bruce Blakeman Joins Sullivan Papain Law Firm To Mark Anniversary Of Tobacco Master Settlement Agreement

{Caption Nassau County Executive Bruce Blakeman Joins Sullivan Papain Law Firm to mark anniversary of tobacco master settlement agreement

Mineola, NY – Nassau County Executive Bruce Blakeman today visited the Sullivan Papain law firm in Garden City with New York State Senator Anthony Palumbo and Nassau County officials to celebrate the upcoming anniversary of a landmark settlement that secured critical funds for public health, curbed tobacco advertising nationwide, and saved countless future lives in the process.

The Tobacco Master Settlement Agreement reached in 1998 effectively stopped major tobacco companies from targeting children in their advertising and secured a $206 billion settlement to reimburse states for healthcare costs related to smoking. It also funded anti-smoking initiatives that led to a major drop in youth smoking rates in subsequent years.

Bob Sullivan, a senior partner at Sullivan Papain, which is celebrating its 100th anniversary this year, helped secure a $25 billion state settlement for New York that benefited Nassau County immensely by allowing officials to address the public health concerns created by tobacco use.

“The funds that were received in this settlement were going toward, and have been going toward, making our county a healthier place. And one of the reasons why we have the safest county in America is the healthy component,” said County Executive Blakeman. “It was a great reason to bring this litigation because so many people were harmed and injured and, quite frankly, killed from tobacco use.”

In remarks to the media, Mr. Sullivan said the work he did as part of the Tobacco Master Settlement Agreement was among the most important of his career.

“The money recovery was great. It was great for Nassau County, great for New York State, great for the taxpayers,” he said. “When you think about it, you haven’t seen an ad for a cigarette on TV, in a magazine, newspaper, radio, or anyplace else. That’s going to save millions of lives going down the road. That’s my proudest accomplishment.”